Past Award Recipients

Creating a non-profit website has never been easier using Essentials

It is a long established fact that a reader will be distracted by the readable content of a page when looking at its layout.

Join a friendly community

Highlight Events

Discover some of the powerful and stunning features of Essentials.

2018

TAN SRI DR. ZETI AKHTAR AZIZ

Dr. Zeti served as Governor of Bank Negara Malaysia from May 2000 to April 2016. She had an important role in managing the resolution of the financial system in 1998 during the Asian financial crisis and the consequent strong recovery of the Malaysian economy. She was also instrumental in transforming Malaysia’s financial system, including overseeing the enactment of twelve new pieces of legislation for the financial sector. During this period, the Malaysian financial system also underwent a period of progressive liberalisation.

In Asia, Dr. Zeti was active in strengthening cooperation and regional financial integration. In 2006, she chaired the regional task force that prepared the report for the future direction of central bank financial cooperation in the East Asian region. At the BIS, she was the chair of the BIS Central Bank Governance Group. In the region she was a founding member of the Bank for International Settlements (BIS) Asian Consultative Council, and was the first Co-chair of the Financial Stability Board Regional Consultative Council Group for Asia. Dr. Zeti also had an extensive role in the global development of Islamic finance, and was active in the global financial inclusion agenda. She has been an important voice for the emerging world on the many issues concerning the international financial system and on financial and economic management.

She is currently Co-chair, Board of Governors of Asia School of Business, established in collaboration with MIT Sloan. In May 2018, following the change in the Government of Malaysia, Dr. Zeti was appointed as a member of the Eminent Council to advise the Government on the Institutional and Structural Reforms required for the country. In July 2018, she was appointed as group chairman of Perbadanan Nasional Berhad (PNB).

Dr. Zeti received her PhD in Economics from the University of Pennsylvania.

Creating a non-profit website has never been easier using Essentials

It is a long established fact that a reader will be distracted by the readable content of a page when looking at its layout.

Join a friendly community

Highlight Events

Discover some of the powerful and stunning features of Essentials.

2016

PROFESSOR DATUK RIFAAT AHMED ABDEL KARIM

Professor Datuk Rifaat Ahmed Abdel Karim enjoys an international reputation as a leader and authority in the Islamic financial services industry (IFSI) at both the professional and academic sectors. He has pioneered the development of Islamic finance for the last several decades. His leadership in the formation of governance, regulatory and Shariah standards, as well as in the development of financial instruments to facilitate liquidity management for Islamic financial institutions (IFIs), has been instrumental in strengthening the position of the IFSI within the broader global economy.

Professor Rifaat has served as the inaugural Secretary-General at both the Accounting and Auditing Organisation for Islamic Financial Institutions (AAOIFI) and the Islamic Financial Services Board (IFSB). During his terms in office at the AAOIFI and the IFSB, Professor Rifaat played a key role in the conception and development of standards and guidelines for the IFSI.

In October 2012, Professor Rifaat assumed the position of Chief Executive Officer of the International Islamic Liquidity Management Corporation (IILM), an international organisation established in October 2010 by central banks, monetary agencies and a multilateral development organisation to facilitate liquidity management for IFIs. Under Professor Rifaat’s leadership, the IILM has successfully issued the first tradable, Shariah-compliant, US dollar- denominated highly rated Sukuk with a tenor of under one year. The IILM Sukuk, which are rated A-1 by Standard & Poor’s Rating Services, represent a new class of assets in the IFSI. These Sukuk are intended to assist IFI in mitigating the disadvantages they have been facing, compared to their conventional counterparts. As of August 2016, a total of $20.03 billion Sukuk have been issued and reissued at maturity.

Professor Rifaat’s contribution to the IFSI has been recognized by the many prestigious international awards that he has received during his career over three decades. These awards notably include the (inaugural) 2004 Euromoney Outstanding Contribution in the Development of Islamic Finance and the 2010 Islamic Development Bank Prize in Islamic Banking and Finance. In 2010, the King of Malaysia awarded Professor Rifaat the Royal Malaysian Honorary Award of Darjah Kebesaran Panglima Jasa Negara (P.J.N.), which carries the title ”Datuk”.

Creating a non-profit website has never been easier using Essentials

It is a long established fact that a reader will be distracted by the readable content of a page when looking at its layout.

Join a friendly community

Highlight Events

Discover some of the powerful and stunning features of Essentials.

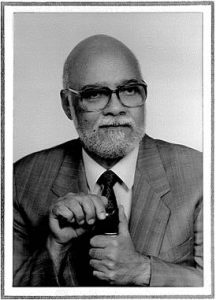

2014

DATO’ DR. ABDUL HALIM ISMAIL

Dr. Abdul Halim, the first Malaysian to receive this award is recognised for his pivotal role in establishing the organisational structure and operating procedures of the first Islamic bank in 1983. He was appointed the Managing Director of Bank Islam and Chairman of the board of Syarikat Takaful Malaysia, the nation’s first Islamic insurance company. In 1994, Dr. Abdul Halim also helped to set up BIMB Securities, the first Islamic stockbroking company in Malaysia. Under his stewardship, both the industry and financial institutions flourished, making Islamic finance an increasingly attractive alternative and complement to conventional finance.

His vision and leadership also steered Bank Islam towards becoming a successful and robust Islamic financial institution upholding Shariah best practices. Bank Islam extended support, collaboration and training for Islamic banks which were subsequently set up within the region.

Dr. Abdul Halim’s expertise in Shariah law as well as Islamic banking and finance has led to his appointment on various Shariah boards of regulators, including Bank Negara Malaysia, Securities Commission Malaysia and Labuan International Business and Financial Centre; and financial institutions. An academician by training, he was the Dean of the Faculty of Economics at the National University of Malaysia (UKM) from 1974 to 1977.

His distinguished qualifications and knowledge in Islamic economics and Islamic banking and finance have also been documented extensively in published articles for seminars and conferences, such as the 7th Meeting of Central Banks and Monetary Authorities and Islamic Banks of the Organisation of the Islamic Conference (OIC) Countries in Malaysia, and the IBC Islamic Banking Conference and Emirates International Forum in Dubai.

Creating a non-profit website has never been easier using Essentials

It is a long established fact that a reader will be distracted by the readable content of a page when looking at its layout.

Join a friendly community

Highlight Events

Discover some of the powerful and stunning features of Essentials.

2012

IQBAL KHAN

The Royal Award for Islamic Finance 2012 was presented to Iqbal Khan for his dedication, drive and extraordinary leadership in accelerating the global growth and accessibility of Islamic finance. He played a prominent role in the course of facilitating, promoting and innovating Islamic finance on a global scale. His passion in providing ethical, community-based financial services has led him to drive further interest among international financial institutions, regulators and academia towards Islamic finance.

Iqbal Khan has played an instrumental role in establishing a number of institutions and initiatives in the Islamic finance industry, including Citi Islamic Investment Bank, the Islamic Finance Project at Harvard University, Meezan Bank, HSBC Amanah and most recently Fajr Capital, of which he is Founding Board Member and Chief Executive Officer. He is also currently a Board Member of Bank Islam Brunei Darussalam, Jadwa Investment and MENA Infrastructure.

With his leadership and dedication, Iqbal Khan motivated the push for a global sovereign sukuk and led the Shariah thought-process towards greater understanding of the concept of foreign currency global sukuk. Successfully proven in creating the evolutionary move from basic banking and finance to more sophisticated product structures, global sovereign sukuk have today become the mainstream fundraising instrument for sovereigns.

In 2006, Iqbal Khan received the Euromoney Award for Outstanding Contribution to Islamic Finance, and was nominated and voted by the Islamic Financial News as the Best Individual Islamic Banker for 2005. He was also recognised by the United States House of Representatives in 2000 for his contribution in the field of finance and economics.

Creating a non-profit website has never been easier using Essentials

It is a long established fact that a reader will be distracted by the readable content of a page when looking at its layout.

Join a friendly community

Highlight Events

Discover some of the powerful and stunning features of Essentials.

2010

THE LATE SHAIKH SALEH ABDULLAH KAMEL

The inaugural Royal Award for Islamic Finance 2010 was awarded to The Late Shaikh Saleh Abdullah Kamel for his visionary drive, extraordinary leadership and personal commitment towards the development of Islamic finance. His work over four decades has fast-tracked the global adoption of Islamic finance and continues to have sustained financial, economic and social impact in the world.

He is widely credited for pioneering the adoption of Shariah-compliant principles in banking and business. In the absence of Islamic finance at the time, his deep personal adherence to Islamic principles led him to be one of the first individuals to devise Islamic contracts for use in his business operations in the 1960s.

In 1969 he founded a group of companies, which amongst others, provides Shariah-compliant retail, corporate and investment banking and treasury services and is today a global organisation comprising subsidiaries in 12 countries with more than 300 branches. Shaikh Saleh Abdullah Kamel followed this by establishing the Islamic Arab Insurance Company in 1979, a pioneering takaful (Islamic insurance) company.

In his efforts to inspire and develop future talent and innovation, Shaikh Saleh Abdullah Kamel established the Islamic Economics Research Centre, King Abdulaziz University and Jeddah Center for Science and Technology in Saudi Arabia. He also founded the Saleh Kamel Centre for Islamic Economy, Al-Azhar University, Cairo and Saleh Kamel Center for Banking Studies and Research, King Saud University, Saudi Arabia. The endeavours of these institutions have led to further innovation development of many Shariah compliant tools, techniques and edicts.

Creating a non-profit website has never been easier using Essentials

It is a long established fact that a reader will be distracted by the readable content of a page when looking at its layout.

Join a friendly community

Highlight Events

Discover some of the powerful and stunning features of Essentials.

2010 (POSTHUMOUS AWARD)

THE LATE DR. AHMAD EL-NAGGAR

The Late Dr. Ahmad El-Naggar’s first modern experiment with Islamic banking took the form of a savings bank based on profit-sharing. Through his introduction of the basic offering for Islamic banking, he was instrumental in providing for the community and establishing a platform for continuous development of the industry globally. To continue the advancement of Islamic finance, Dr. Ahmad El-Naggar established the Institute of Islamic Banking and Economics in Cairo which provides for the intellectual and operational needs of Islamic banks and the development of a new generation of Islamic finance talent.